Receive up to $2,450 for a Qualifying Heat Pump Water Heater

What is a Heat Pump Water Heater?

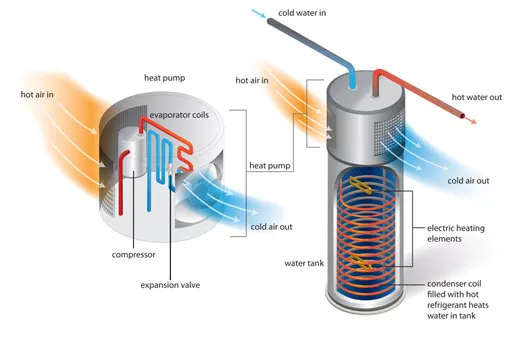

Heat Pump Water Heaters use electricity to move heat from one place to another instead of generating heat directly – taking the heat from surrounding air and transferring it to water in an enclosed tank. During periods of high hot water demand, some “hybrid” models can switch to standard electric resistance heat automatically.

Helpful Heat Pump Water Heater Information

- Heat pump water heaters work most efficiently in temperatures between 40°F and 90°F, and current models easily handle hotter or cooler temperatures

- Access to air allows heat pump water heaters to operate at peak performance. Most models need about 750 to 1000 cubic feet of air, which is about the size of a 10 ft x 10 ft room. If available space is more limited than this, a louvered door can also help support the required air circulation

- Most models require a dedicated 240 Volt outlet (like a dryer outlet)

- Heat pump water heaters produce pure, clean, non-corrosive condensate water which can be directed to an existing drain or condensate pump

Heat Pump Water Heater Advantages

- Offer both heating and cooling, 2-in-1!

- Are more efficient than boilers or electric heaters

- Are often cheaper to run than traditional HVAC systems

- Can be integrated with a gas furnace for back-up on extremely cold days

- Can work with or without air ducts

Current Incentives & Rebate Programs

Discover a range of exciting incentive and rebate programs designed to support your sustainable energy goals. Explore the list of available programs below to find the perfect fit for your needs.

What Rebates are Offered?

| Product Name | Description of Product | Maximum Rebate |

| Heat Pump Water Heater | Must be ENERGY STAR certified and installed by an Authorized Program Contractor |

$1,750 from HEAR (coming soon) $700 from ECP |

Home Energy Efficiency Rebates (HEAR)

The HEAR Program will offer low-income New Mexicans incentives for ENERGY STAR® certified Heat Pump upgrades. New Mexicans who earn less than 80% AMI or participate in certain means-tested programs qualify. New Mexico has allocated 75% of rebates to single-family homes and 25% of rebates to multi-family homes.

Eligibility Requirements

- Income Eligibility: You need to earn less than 80% of your county’s Area Median Income (AMI) or participate in specific state or federal benefit programs.

- Property Requirement: You must own and live in a single-family home, duplex, triplex, quadplex, manufactured, or townhome.

Click here for more information about the HEAR Program.

Sustainable Building Tax Credit: Energy Conserving Products (ECP)

The New Mexico Sustainable Building Tax Credit offers financial incentives for incorporating energy-efficient and environmentally friendly features into buildings. Energy Conserving Products (ECP) are key components of this program, requiring items to be ENERGY STAR rated and meet specific insulation standards. By using ECPs, individuals and businesses can reduce energy consumption and qualify for tax benefits.

Eligibility Requirements

- Energy-conserving products must reduce the energy consumption of a residential or commercial building.

- Products must contribute towards the electrification of sustainable buildings with ENERGY STAR heat pump furnaces and water heaters.

- Products must be ENERGY STAR rated for the location installed.

- Products must meet the insulation requirements outlined in 3.3.35.14 or 3.4.22.11 NMAC.

Funding

- Affordable Housing & Low-Income taxpayers earn 100% of product and installation cost up to $700 per heat pump water heater installed.

- Non-Affordable Housing & Non-Low-Income taxpayers earn 50% of product and installation costs up to $350 per heat pump water heater installed.

How to Apply

You can submit an electronic application with the Energy, Minerals Natural Resources Department for products installed from January 1, 2021, onward for taxable years before January 1, 2028, as long as the tax credit is still available. The department will review your documentation before issuing a certificate of eligibility for the 2021 Sustainable Building Tax Credit for ECPs. If the annual cap for this tax credit has been reached, you’ll receive a certificate of eligibility for the next year with available funds.

There may be additional rebates available for New Mexico Gas Company customers with homes built between April 1, 2025 and March 31, 2026. Visit NMGC New Homes Rebates for more information.

Upcoming Incentive & Rebate Programs

These upcoming programs will offer financial support for various energy-efficient projects and renewable energy installations. Explore the list of what’s coming soon, and be prepared to take advantage of these opportunities as soon as they launch.

Home Energy Rebates

The HER Program will offer low-income New Mexicans rebates on home energy efficiency upgrades. New Mexicans who earn less than 80% AMI or participate in certain means-tested programs qualify. New Mexico has allocated 75% of rebates to single-family homes and 25% of rebates to multi-family homes.

Date Program Goes Live: TBA

Stay informed about upcoming energy-efficient products!

Sign up now to be notified as soon as they become available and ensure you don’t miss out on the latest innovations for your home or business.