Receive up to $3,600 for Qualifying Insulation Products

What Qualifies as Insulation Product?

Energy-conserving insulation or air sealing products that increase the existing insulation R-value by an R-value greater than 10, with R-value being a measure for the rate of heat loss. R-value is a measure for the rate of heat loss. Insulation products include wall, ceiling/attic, floor and foundation insulation that is ENERGY STAR certified blanked or rigid board insulation. Air sealing upgrades may include insulation duct sealing, windows, kitchen and bathroom vent fans, caulking and weatherstripping.

How to use / how it works

- DIY or professional insulations that work to seal home.

Advantages

- Increase in home energy efficiency

- Reduction in electricity prices paid by consumers

Helpful Insulation and Air Sealing Information

The U.S. EPA estimates that homeowners can save an average of 15% on heating and cooling costs (or an average of 11% on total energy costs) by air sealing their homes and adding insulation in attics, and under floors over crawl spaces and basements. Air leaking around doors, and windows and through floors and walls wastes energy and makes your home colder in the winter and hotter in the summer.

While adding insulation is a relatively easy DIY project, it’s best to first air seal the space you’re insulating. See the links to the right for helpful how-to tips:

How-To Tips

It’s best to apply air sealing measures before installing insulation. Review “How To” Information below:

Current Incentives & Rebate Programs

Discover a range of exciting incentive and rebate programs designed to support your sustainable energy goals. Explore the list of available programs below to find the perfect fit for your needs.

What Incentives are Offered?

| Product Name | Description of Product | Maximum Incentive (customers can ONLY receive $1,600 max from HEAR and $2,000 max from ECP) |

| DIY Wall, Ceiling/Attic, Floor and Foundation Insulation | ENERGY STAR certified blanket (roll or batt) or rigid board insulation at a participating retailer | $1,600 from HEAR Up to $2,000 from ECP |

| Professional Insulation and Air Sealing Projects | ENERGY STAR certified products are installed by authorized program contractors. Products include insulation, weather stripping, caulking, and ventilation to professionally seal homes | $1,600 from HEAR (Coming soon) Up to $2,000 from ECP |

Home Energy Efficiency Rebates (HEAR)

The HEAR Program will offer low-income New Mexicans rebates or point-of-sale coupons on qualifying energy-star appliances and high-efficiency upgrades. New Mexicans who earn less than 80% AMI or participate in certain means-tested programs qualify. New Mexico has allocated 75% of rebates to single-family homes and 25% of rebates to multi-family homes.

Eligibility Requirements

- Income Eligibility: You need to earn less than 80% of your county’s Area Median Income (AMI) or participate in specific state or federal benefit programs.

- Property Requirement: You must own and live in a single-family home, duplex, triplex, quadplex, manufactured, or townhome.

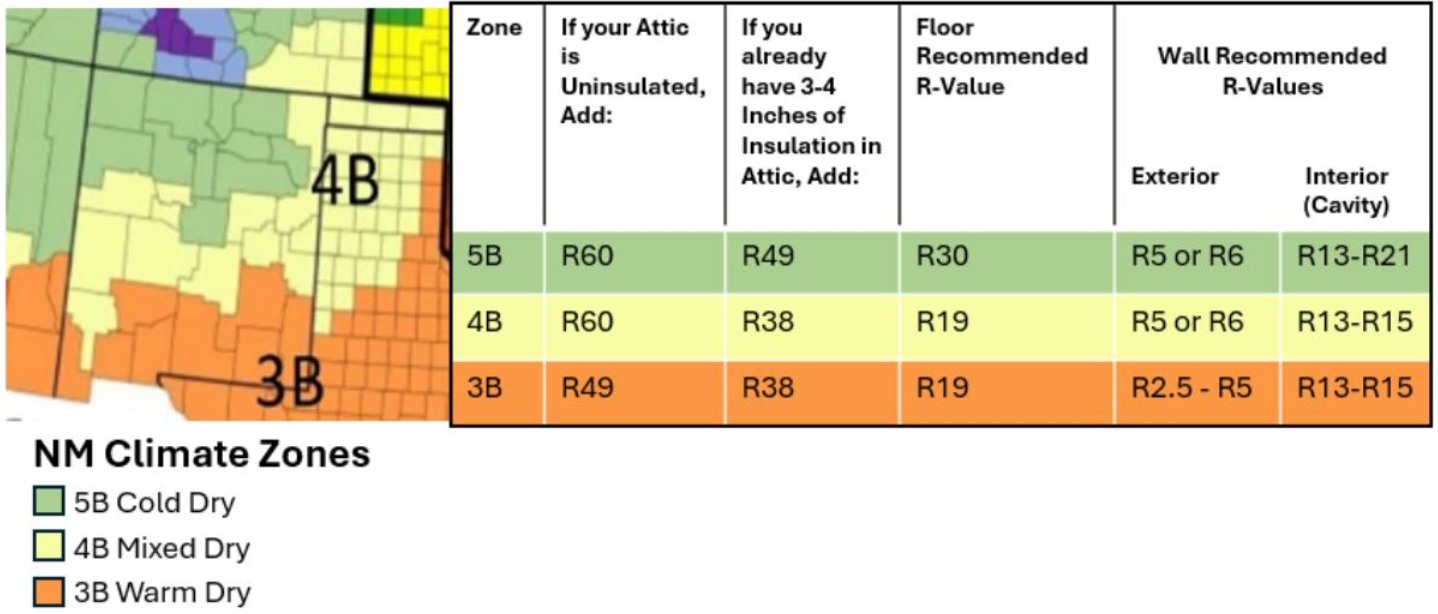

- Insulation Standards: Products must meet the insulation requirements outlined in 3.3.35.14 or 3.4.22.11 NMAC.

Click here for more information about the HEAR Program.

How to Apply

With up to $1,600 in savings available through the HEAR program, you can upgrade your home insulation easily. Don’t miss out—find out what you’re eligible for and start your journey to a more energy-efficient home today!

How this Program Works

You can choose between a coupon worth $1,600 for any combination of qualifying fiberglass, mineral wool, or rigid board insulation at qualifying retailers (for DIY projects), OR you can receive a $1,600 incentive for a professional insulation and air sealing project completed by a participated contractor. Please note, Only ONE $1,600 insulation and air sealing incentive will be awarded per dwelling.

DIY Retail Coupon Option:

If you choose the DIY product coupon, all insulation must be purchased IN ONE TRANSACTION. You should measure the space and evaluate the amount of attic/ceiling, wall, floor and/or foundation insulation you currently have in your home and plan for where you want to install new insulation and the type(s) you need.

You’ll need to develop an estimate of how much your new insulation will cover, (I.e. 100% of ceiling? 50% of flooring above unconditioned space?) BEFORE you start the coupon application, so that you can answer the application questions.

You’ll also be asked to choose the retailer you will purchase your products from. We encourage you to View Retail Locations and Qualifying Products List links to determine which retailer’s coupon you prefer.

Professional Installation Option:

Use the Find a Participating Contractor link to choose a participating contractor, who will develop a project estimate for your approval. The contractor will complete the project and invoice you, giving you a $1,600 credit on your invoice.

Sustainable Building Tax Credit: Energy Conserving Products (ECP)

New Mexico tax credit created to help NM homeowners and businesses save on taxes when installing energy-efficient upgrades.

Eligibility

New Mexican property owners, either residential or commercial, who install eligible products through December 31, 2027.

Funding

- Affordable Housing & Low-Income taxpayers earn 100% of product and installation cost, up to $1,000 per product installed.

- Non-Affordable Housing & Non-Low-Income taxpayers earn 50% of product and installation costs, up to $500 per product installed.

How to Apply

- Using EMNRD’s online application portal linked below and uploading the pertinent supporting documents, property owners can apply for tax credits.

- If the project is approved, the applicant will receive an email and a certificate confirming eligibility, which the applicant will use when filing New Mexico State taxes.

You can submit an electronic application with the Energy, Minerals Natural Resources Department for products installed from January 1, 2021, onward for taxable years before January 1, 2028, as long as the tax credit is still available. The department will review your documentation before issuing a certificate of eligibility for the 2021 Sustainable Building Tax Credit for ECPs. If the annual cap for this tax credit has been reached, you’ll receive a certificate of eligibility for the next year with available funds.

Upcoming Incentive & Rebate Programs

These upcoming programs will offer financial support for various energy-efficient projects and renewable energy installations. Explore the list of what’s coming soon, and be prepared to take advantage of these opportunities as soon as they launch.

Home Energy Rebates

The HER Program will offer low-income New Mexicans rebates on home energy efficiency upgrades. New Mexicans who earn less than 80% AMI or participate in certain means-tested programs qualify. New Mexico has allocated 75% of rebates to single-family homes and 25% of rebates to multi-family homes.

Date Program Goes Live: TBA

Stay informed about upcoming energy-efficient products!

Sign up now to be notified as soon as they become available and ensure you don’t miss out on the latest innovations for your home or business.