Receive up to $6,000 for a Qualifying Solar Panel Installation

What Qualifies as an Eligible Solar Panel?

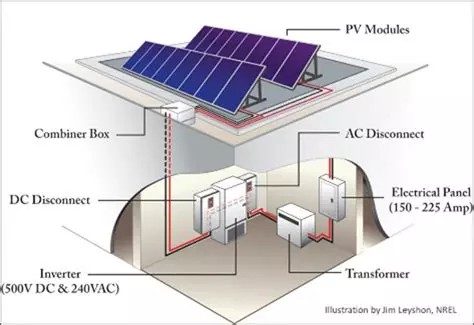

Solar energy technologies capture the sun’s radiation and turn it into useful forms of energy. The two main types of solar energy technologies are photovoltaics (PV) and concentrating solar-thermal power (CSP). (source: DOE)

How to use / how it works

- Solar arrays can be installed on a roof of a home or a carport, allowing individual homeowners to realize solar benefits such as direct clean energy

- Solar PV and Solar Thermal panels work by converting the energy from sun into power or heat, respectively

Advantages

- Solar can reduce homeowner’s monthly electricity bills

- Solar provides a direct clean energy source that results in reduction of harmful pollutants

- If so installed, can provide electricity during blackouts

Helpful Links

Current Incentives & Rebate Programs

Discover a range of exciting incentive and rebate programs designed to support your sustainable energy goals. Explore the list of available programs below to find the perfect fit for your needs.

New Solar Market Development Income Tax Credit (NSMDTC)

Eligibility Requirements

A NM taxpayer who has purchased and installed a solar thermal or solar photovoltaic system is eligible, as long as:

- The taxpayer is not a dependent of another individual.

- The taxpayer has purchased and installed a solar thermal system or a photovoltaic system on or after March 1, 2025.

How to Apply

Applicants must submit an electronic application with supporting documents to the Energy Minerals and Natural Resources Department (EMNRD) within one year of the taxable year of the solar energy system installation, or until funds are exhausted, whichever comes first. Complete applications are reviewed in the order received, checking for content accuracy and fund availability.

What Incentives are Offered?

| Product Name | Product Description | Maximum Incentive |

| Solar Photovoltaic | Solar PV technology converts direct sunlight into electricity through an individual panel made of semiconductors. | $6,000 tax credit |

| Solar Thermal System | Solar thermal technology collects sunlight through the use of reflectors (mirrors) and receivers, on which reflectors focus sunlight. | $6,000 tax credit |

Upcoming Incentive & Rebate Programs

These upcoming programs will offer financial support for various energy-efficient projects and renewable energy installations. Explore the list of what’s coming soon, and be prepared to take advantage of these opportunities as soon as they launch.

Solar for All

“Solar for All” is a U.S. Environmental Protection Agency (EPA) program designed to make solar power available to low-income households across the country. The program is allocating a total of $7 billion nationwide to fund solar systems for households that otherwise might not be able to access this clean, renewable form of energy. The State of New Mexico was awarded a $156 million Solar for All grant in April 2024. The Energy, Minerals and Natural Resources Department is administering New Mexico’s Solar for All program.

Date Program Goes Live: TBD

Stay informed about upcoming energy-efficient products!

Sign up now to be notified as soon as they become available and ensure you don’t miss out on the latest innovations for your home or business.