Receive up to $3,400 for a Qualifying Electric Vehicle & Charging Station

What Qualifies as a Clean Car?

Battery electric vehicles (BEV), plug-in hybrid electric vehicles (PHEV), or hydrogen fuel-cell electric vehicles (FCEV) that has a maximum value of $55,000 for new cars or $25,000 for pre-owned vehicles. When adding on the Clean Car Charging Unit Tax Credit, individuals can save an additional $400 with the installation of a standard unit.

How It Works

- A vehicle purchase or lease must be through a motor vehicle dealer licensed by the New Mexico motor vehicle division, or a dealer located on tribal land within New Mexico.

- A lessee of a vehicle must have entered into a new lease for at least three years.

- A previously-owned motor vehicle must have a minimum one-year extended manufacturer’s warranty against defects and repairs.

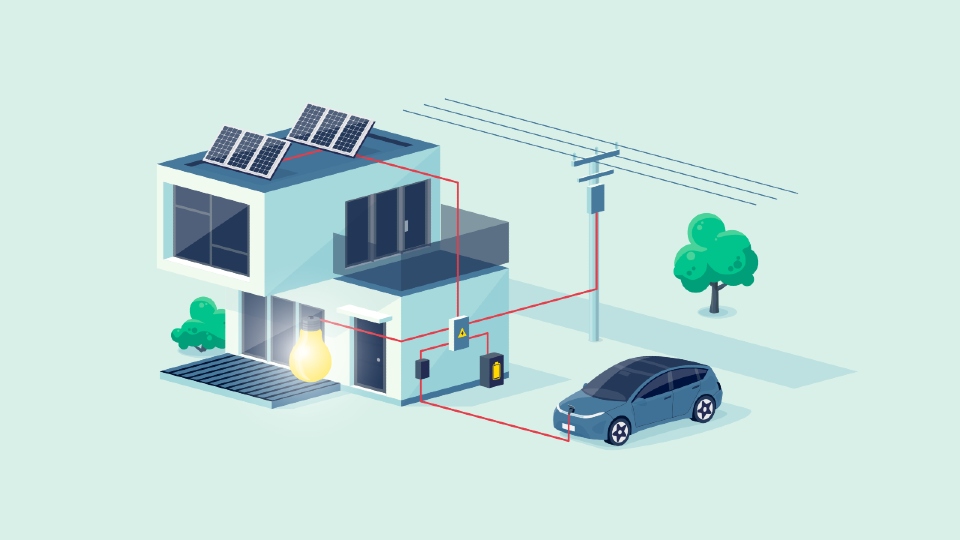

If you install your own Level 1 or Level 2 charger at your home, you could be eligible for an additional $400 tax credit. These credits are also refundable, so you’ll get the funds even if you have no tax liability for the year. Charging stations must be installed by a licensed electrician and connected to your local electricity network.

Clean Car Advantages

- Reduction in gas prices paid by the consumer

- Reduction in harmful pollutants

- Fun to drive

Types of Clean Cars

- Battery Electric Vehicle (BEV): Cars powered by electric motors instead of internal combustion engines. Their large batteries must be plugged to charge.

- Plug-in Hybrid Electric Vehicles: Cars powered by both a battery and an internal combustion engine. Typically, this car will run on electric power until the battery runs out, and after that the car automatically switches to use the internal combustion engine. Can accept both gasoline or electricity.

- Fuel Cell Electric Vehicles: Cars that use an onboard hydrogen-powered fuel cell to make electricity. The car then runs on the electricity. The amount of energy in the car is not determined by the size of the battery, but the size of the hydrogen-powered fuel cell, which is refilled through stored compressed hydrogen gas in a tank.

Source: Loughborough University

Current Incentive & Rebate Programs

The Clean Car Income Tax Credit is designed to encourage the adoption of clean transportation. This tax credit benefits both individuals and businesses purchasing electric and zero-emission vehicles. It also supports the installation of residential and commercial charging stations.

Clean Car State Tax Credit

- State tax credit designed for individuals and businesses for EVs, plug-in hybrids, and other zero-emission vehicles as well as for home and commercial charging stations.

- Eligibility: New Mexican property owners, either residential or commercial, who install eligible products through December 31, 2027.

- Funding: $3,000 for a qualifying vehicle purchase, with an additional $400 available for the addition of the charging unit.

- EMNRD’s Incentive Program page

State tax credit for residential or commercial for purchases of an electric vehicle, plug-in hybrid electric vehicle or fuel cell vehicle, or new leases of at least three years for one of these vehicles.

For more information see our frequently asked questions (FAQ’s).

- Free Download – Savings on Charging Station Infrastructure Flyer

- Free Download – Get Up to $3,000 Credit to Buy a Clean Car Flyer

- Download – Process for Consumer to Claim Clean Car Tax Credit

- Download – Process for Consumer to Transfer Clean Car Tax Credit to Dealer

Eligibility Requirements

- Up to $400 is available for level 1 and level 2 electric vehicle chargers. Up to $25,000 is available for direct current fast charger or fuel cell charging unit.

- Eligibility: New Mexican property owners, either residential or commercial, who install eligible products through December 31, 2027.

- EMNRD’s Incentive Program page

Sustainable Building Tax Credit: Energy Conserving Products

New Mexico tax credit created to incentivize NM homeowners and businesses to use sustainable building practices and energy-efficient products. For EV Ready Equipment to qualify, it must be atleast 40 amps, connected to at least a 240 volt dedicated branch circuit for servicing electric vehicles that terminates in a suitable termination point, such as a receptacle or junction box, and is located in reasonably close proximity to the proposed location of the parking spaces.

Funding

- $3,000 for a qualifying vehicle purchase, with an additional $400 available for the addition of the charging unit.

How to Apply

- Using EMNRD’s online application portal linked below and uploading the pertinent supporting documents, property owners can apply for tax credits.

- If the project is approved, the applicant will receive an email and a certificate confirming eligibility, which the applicant will use when filing New Mexico State taxes.

What Incentives are Offered?

This table shows the eligible incentive amounts depending on the type of car purchased and date of purchase.

Vehicles

| Tax year of vehicle purchase | 2024-2026 | 2027 | 2028 | 2029 | |

| New | EV | $3,000 | $2,200 | $1,470 | $960 |

| Plug-in hybrid or Fuel Cell | $2,500 | $1,850 | $1,225 | $800 | |

| Used | EV | $2,500 | $1,850 | $1,225 | $800 |

| Plug-in hybrid or Fuel cell | $2,000 | $1,480 | $980 | $640 |

ECP EV Ready tax credit – up to $1,000 for low-income taxpayers: up to $3,000 for a commercial property

Charging Unit

| Charging unit type | Maximum Amount of Tax Credit |

| Direct current fast charger | $25,000 |

| Fuel cell charging unit | $25,000 |

| Other electric vehicle charging units (e.g. Level 2) | $400.00 |

Stay informed about upcoming energy-efficient products!

Sign up now to be notified as soon as they become available and ensure you don’t miss out on the latest innovations for your home or business.